Have you ever watched the Antiques Roadshow program on PBS? I have…some of the purest, family reality TV available over broadcast air. Since the show started 30 years ago it has exploded into a wide-ranging branded experience that goes on tour to locations around the country. The program website has a section focused on appraisals1 of the sort of personal property assets that have always been featured on the show – paintings, collectibles, antique furniture, etc.

Years ago, during my first decade at the IRS, I worked as an engineer and valuation specialist. Part of my responsibility as a valuation specialist was supporting the revenue agents examining tax returns when there was a deduction claimed for a noncash charitable donation of a high value item. In these types of audits, one of the first things an examiner will verify is the presence of two items:

· IRS Form 8283, Noncash Charitable Contributions

· A qualified appraisal report.

Taxpayers are always free to make donations to any IRC §501(c)(3) organization of their choosing. However, whether the personal property donated is fine artworks, coins, classic Marvel or DC comics, Pokémon or Dragonball Z trading cards, there are specific rules that depend on what is being donated, when the asset is delivered to the recipient, most of all, written documentation confirming and substantiating the value of the asset.

Someone just spent $236,000,000 on a painting. Here’s why it matters for your wallet.

The WSJ just reported the highest price ever paid for modern art at auction.

While equities, gold, bitcoin hover near highs, the art market is showing signs of early recovery after one of the longest downturns since the 1990s.

Here’s where it gets interesting→

Each investing environment is unique, but after the dot com crash, contemporary and post-war art grew ~24% a year for a decade, and after 2008, it grew ~11% annually for 12 years.*

Overall, the segment has outpaced the S&P by 15 percent with near-zero correlation from 1995 to 2025.

Now, Masterworks lets you invest in shares of artworks featuring legends like Banksy, Basquiat, and Picasso. Since 2019, investors have deployed $1.25 billion across 500+ artworks.

Masterworks has sold 25 works with net annualized returns like 14.6%, 17.6%, and 17.8%.

Shares can sell quickly, but my subscribers skip the waitlist:

*Per Masterworks data. Investing involves risk. Past performance not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

🧾 WHAT is a “Qualified Appraisal”?

If you ever consider donating personal property to a charity and deducting more than $5,000, the one thing you absolutely MUST do…get a qualified appraisal signed and dated by a qualified appraiser. A qualified appraisal is an appraisal document that:

Is made, signed, and dated by a qualified appraiser (defined below) in accordance with generally accepted appraisal standards,

Meets the relevant requirements of Treas. Reg. §1.170A-17(a),

Is issued no earlier than 60 days before the date of the contribution and no later than the date the tax return is due, including extensions,

For an appraisal report issued on or after the date of the contribution, the valuation effective date must be the date of the contribution.

For an appraisal report issued prior to and no earlier than 60 days before the date of contribution, the valuation effective date is the prospective date of contribution, and,

Does not involve a prohibited appraisal fee.

🧾 WHAT kind of specific information is required within the “Qualified Appraisal”?3

A description of the property in sufficient detail for a person who is not generally familiar with the type of property to determine that the property appraised is the property that was (or will be) contributed,The physical condition of any tangible property,The date (or expected date) of contribution,

The terms of any agreement or understanding entered (or expected to be entered) by or on behalf of the donor and donee that relates to the use, sale, or other disposition of the donated property, including, for example, the terms of any agreement or understanding that:

Temporarily or permanently restricts a donee's right to use or dispose of the donated property,

Earmarks donated property for a particular use; or

Reserves to, or confers upon, anyone (other than a donee organization or an organization participating with a donee organization in cooperative fundraising) any right to the income from the donated property or to the possession of the property, including the right to vote donated securities, to acquire the property by purchase or otherwise, or to designate the person having the income, possession, or right to acquire the property;

The name, address, and taxpayer identification number of the qualified appraiser and, if the appraiser is a partner, an employee, or an independent contractor engaged by a person other than the donor, the name, address, and taxpayer identification number of the partnership or the person who employs or engages the appraiser,

The qualifications of the qualified appraiser who signs the appraisal, including the appraiser's background, experience, education, and any membership in professional appraisal associations,

A statement that the appraisal was prepared for income tax purposes,

The date (or dates) on which the property was valued,

The appraised fair market value (FMV) on the date (or expected date) of contribution,

The method of valuation used to determine FMV, such as the sales comparison approach, the cost approach, or the income approach; and

The specific basis for the valuation, such as any specific comparable sales transaction.

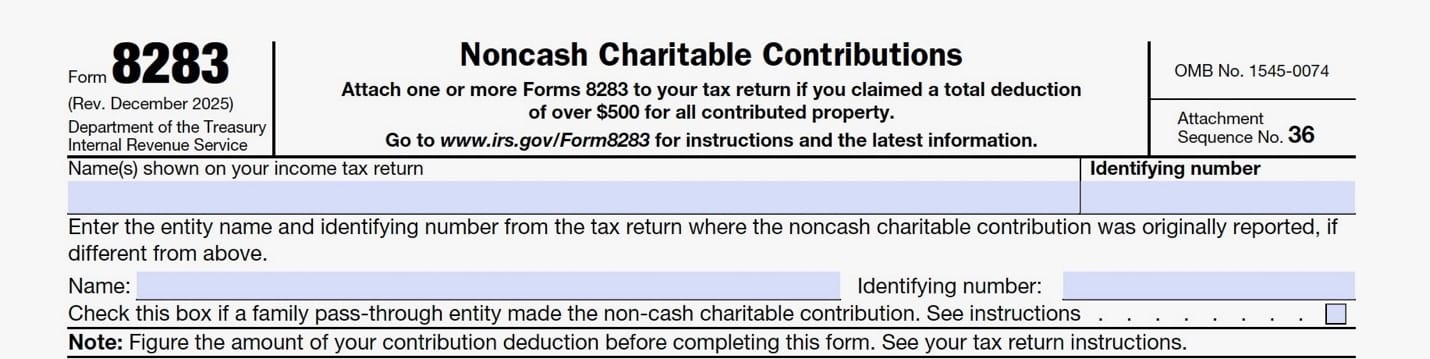

Here’s what the top of IRS Form 8283 looks like:

IRS Form 8283

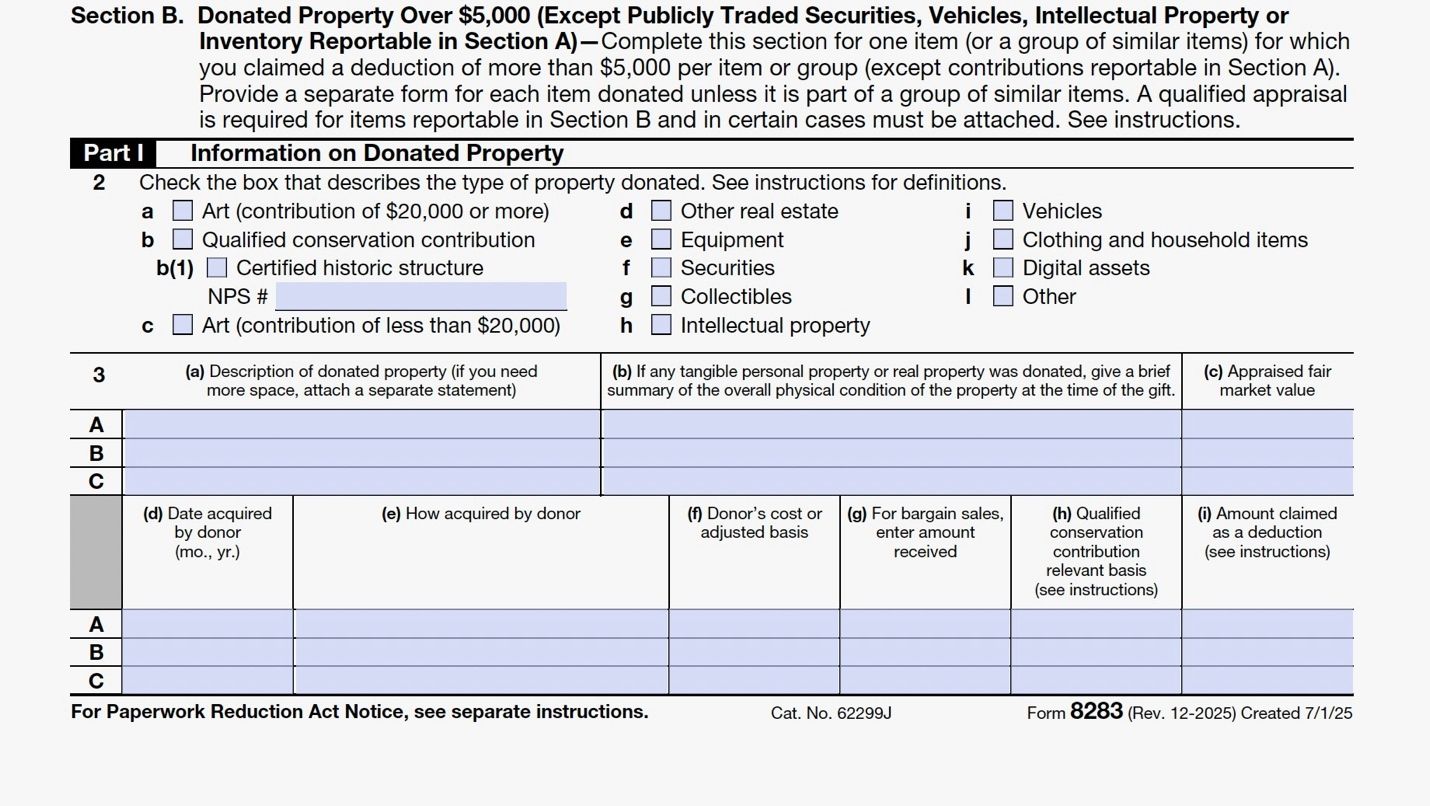

When the appraised value of donated assets, e.g., paintings, sculptures, collectibles, is greater than $5,000, more specific information is required in Part I, Section B of this form.

IRS Form 8283

Notice the check box for Part I, Line 2a above. According to the IRS instructions for Form 8283, if your deduction for art is $20,000 or more, you must attach a complete copy of the signed appraisal to your return. For individual objects valued at $20,000 or more, a photograph must be provided upon request. The photograph must be of sufficient quality and size (preferably an 8 x 10-inch color photograph) or a high-resolution digital image to fully show the object.

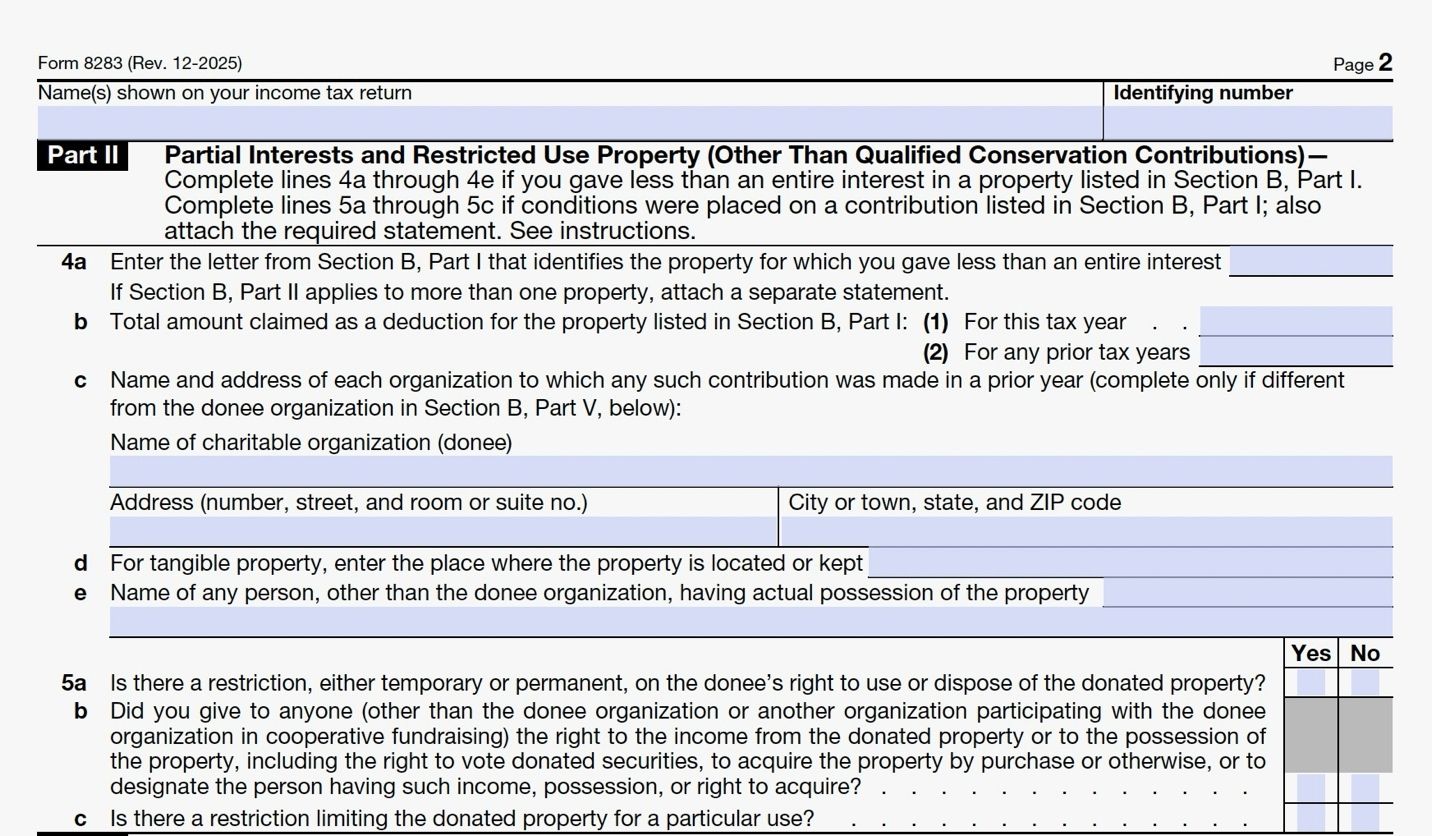

Donations of partial or fractional interests of assets require submission of details in Part II that are even more granular.

IRS Form 8283

IRC §170(f)(3)(B)(ii) (Exception to denial of deduction in case of certain contributions of partial interests in property) and Treas. Reg. §1.170A-7 (Contributions not in trust of partial interests in property) cover the framework of the complex scenario of donating an undivided partial interest in property. Clearly this is an area where a taxpayer should engage the expertise of a tax professional and qualified appraiser with experience in the evaluating the specific type of personal property donated.

The Internal Revenue Service (IRS) Art Appraisal Services (AAS) team is charged with the review of FMV determinations that are attached to Form 8283. While works of art selected for review are typically greater than $150,000, that is not always the case.3

The bottom line is, when donating noncash asset, a taxpayer needs to be prepared to substantiate4 their claim for a tax deduction with a fair market value determination and qualified appraisal report that meets long held standards of asset valuation.

There’s the scoop, everyone! Thanks for taking the time to check out this special edition of the Tax Clarity Newsletter.

References (4)

1 Newest Appraisals, PBS Antiques Roadshow, last accessed on January 16, 2026.

2 26 CFR 1.170A-17, last accessed on January 17, 2026.

3 IRS Art Appraisal Services, last accessed on January 16, 2026.

4 26 CFR 1.170A-16, last accessed on January 17, 2026.

DISCLAIMER: The information in this newsletter is derived from public information, provided for education purposes. It is not provided as a financial advisory service and should not be relied upon as such. For advice on a specific tax matter, please consult a tax professional.